carried interest tax loophole

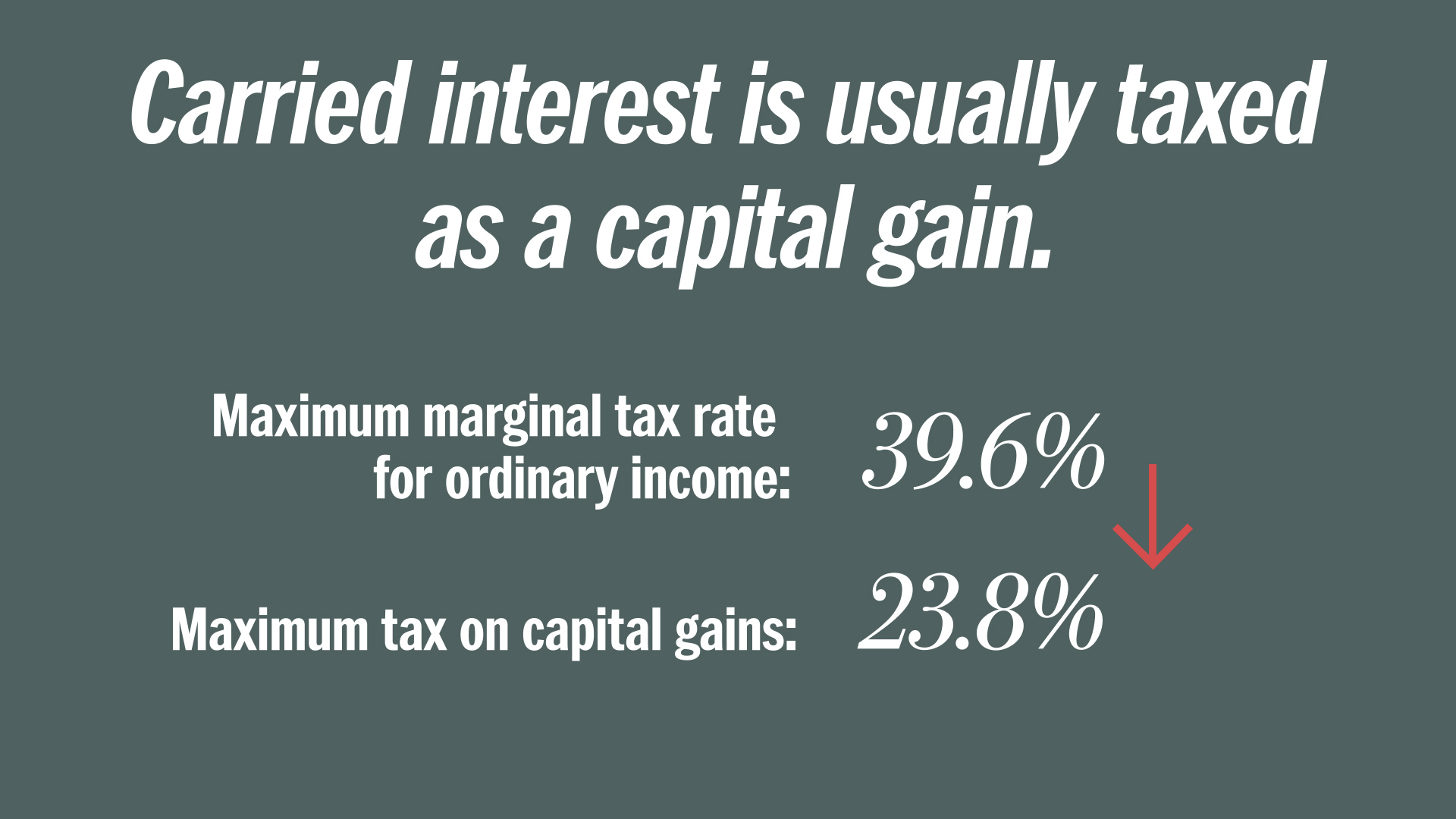

If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received.

The carried interest loophole allows private equity barons to claim large parts of their compensation for services as investment gains which allows them to pay lower tax rates than.

. 14 2018 1144 am ET. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes. One of the most extreme examples of tax privilege is the so-called carried interest loophole.

Ron Wyden D-OR and Sheldon Whitehouse D-RI introduced the Ending the Carried Interest Loophole Act the Bill. 1639 would treat the grant of carried interest to a general partner as a loan from the limited partners made at a preferred interest rate. Ending the Carried Interest Loophole Act.

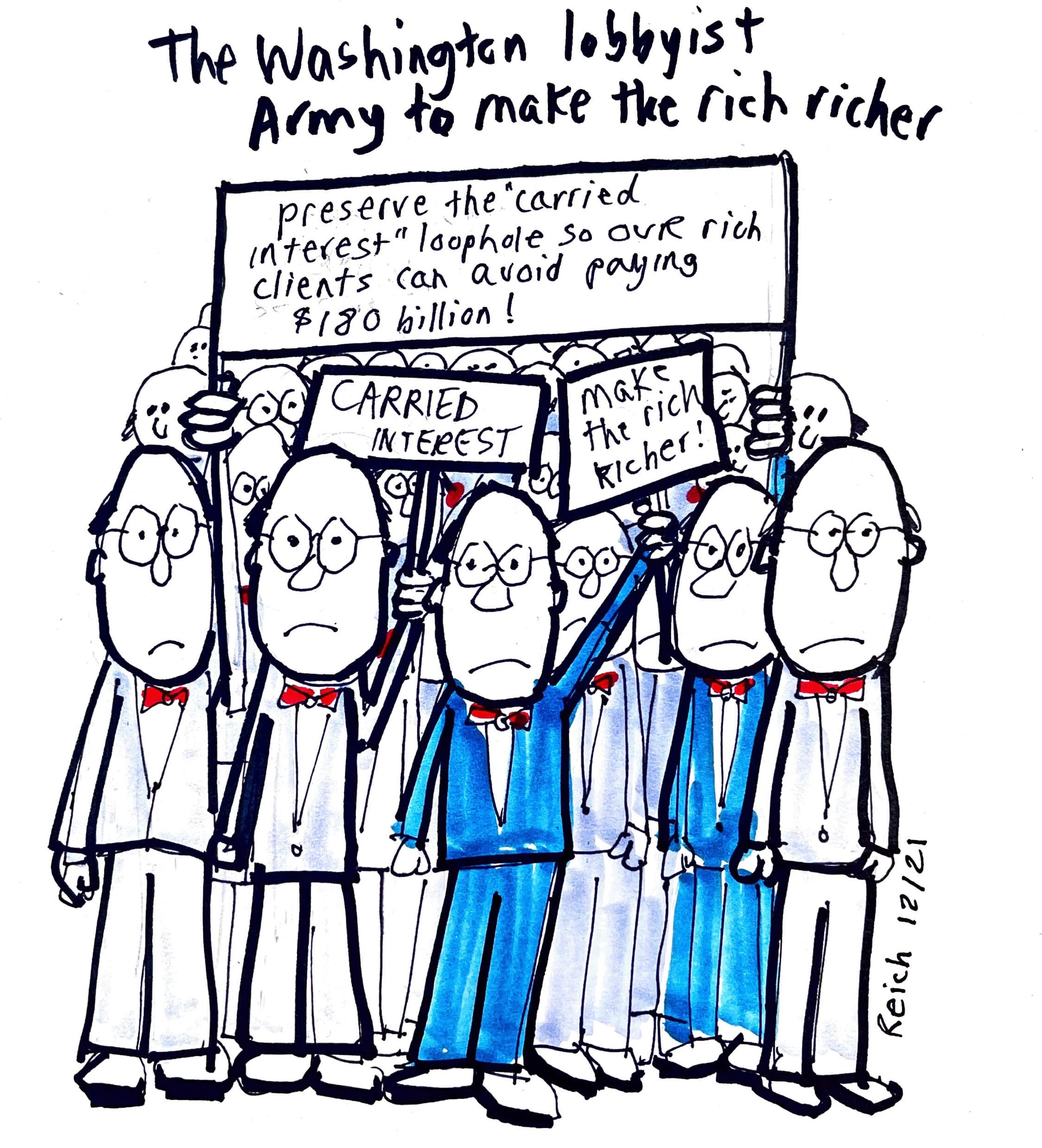

All of these types of investment firms have been accused of victimizing the public evading their tax obligations and benefitting from a preferential tax treatment buttressed by spending millions. Because its not classified as ordinary income general partners have to pay far less tax than they normally would. Many politicians want to close the carried interest tax loophole for private equity managers.

Or the Proposal aimed at changing the tax treatment of. They see it as a tax loophole that benefits the rich. The carried interest loophole benefits hedge funds venture capital real estate partnership and private equity managers almost exclusively.

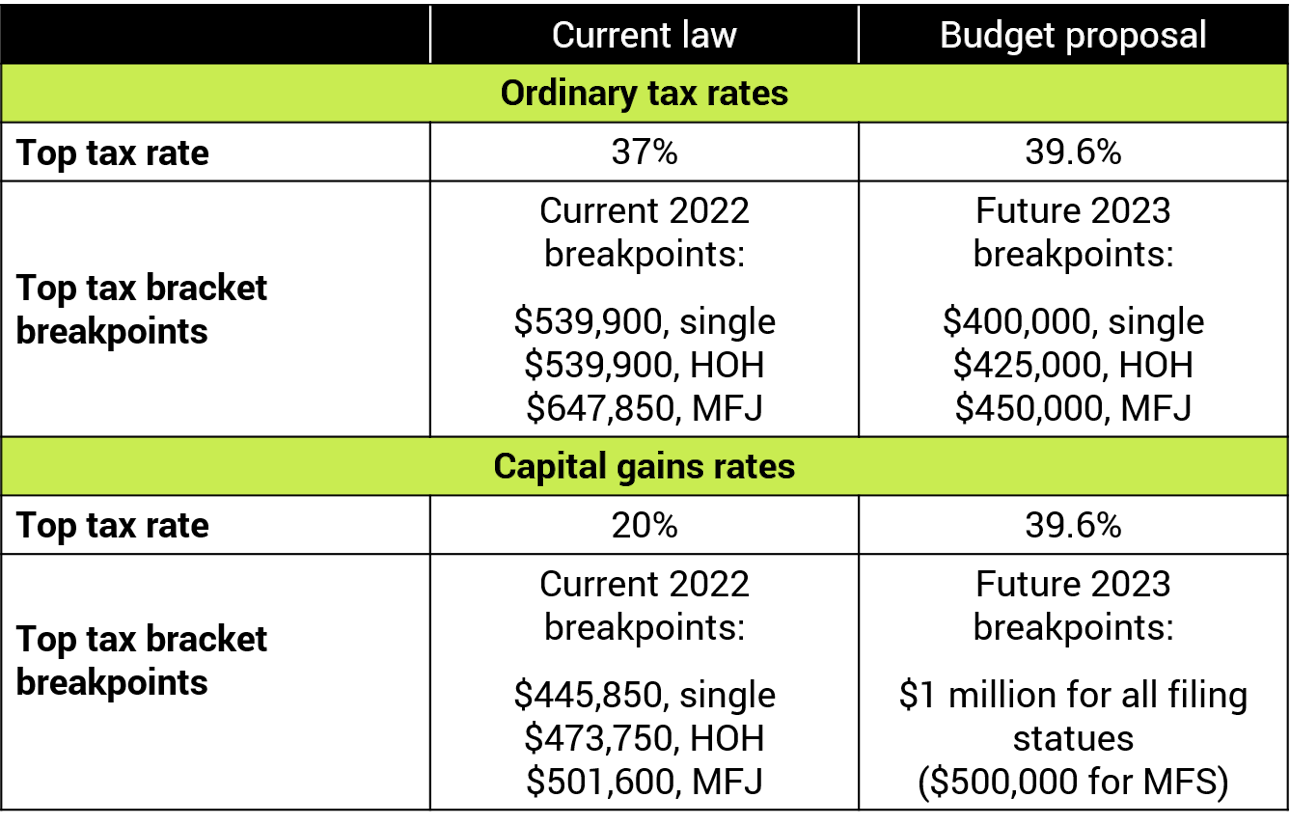

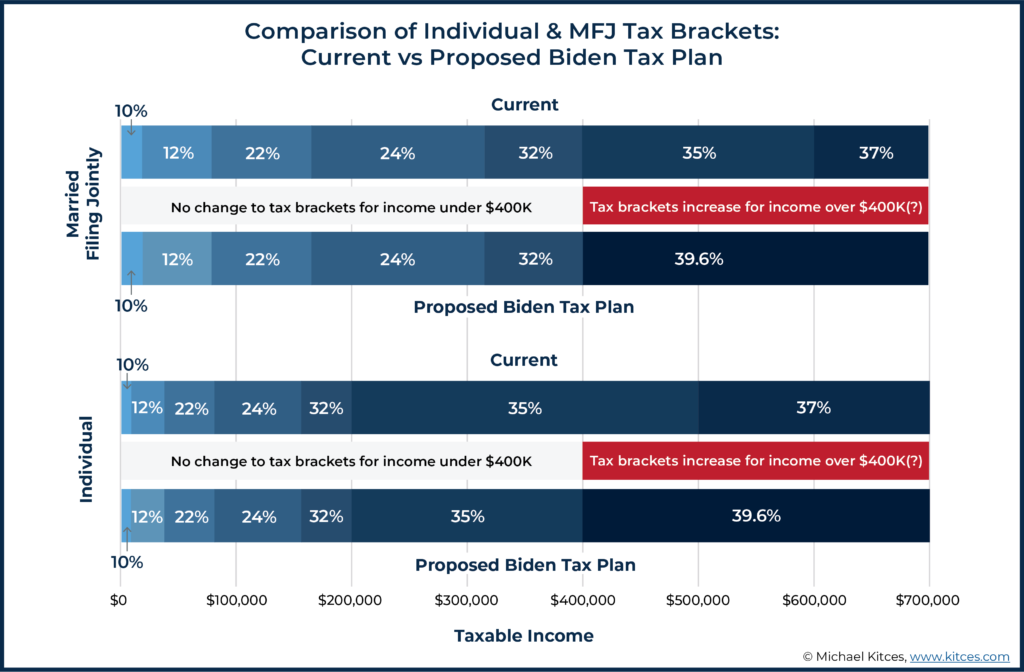

For 100 years since federal taxation of. Investment fund managers are compensated for their advice and management services. In summary the Carried Interest Fairness Act of 2021 would seek to tax all carried interest allocations at ordinary rates regardless of the character of income determined at the partnership level and only for taxpayers with taxable income exceeding 400000.

The proposed Ending the Carried Interest Loophole Act S. This allows wealthy private equity real estate and hedge fund managers to claim the fees they receive for their services as capital gains which are taxed at a rate of just 238 percent instead of the top marginal income tax rate of 37 percent. At the present time changing the tax treatment of carried-interest seems difficult given the political clout of the lucky few who benefit.

This same loophole also fuels other predatory investing strategies that originate with private equity and real estate developers. The carried interest loophole is unfair to everyone except the fabulously rich who benefit from it Photograph. This creates a controversy that carried interest is a tax loophole.

The House voted in December to eliminate the carried interest loophole which would raise an estimated 25 billion in revenue over ten years to help pay for the extension of the research and experimentation tax credit and other tax provisions. In this light the Tax Cuts and Jobs Act of 2017 increased the minimum holding period of an investment from one year to three years. We learn what carried interest is and how to calculate it for PE VC funds and also discuss the carried interest tax loophole.

The lawmakers provided this example. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes. Senators Tammy Baldwin D-WI Joe Manchin D-WV and Sherrod Brown D-OH today introduced tax reform legislation to close the carried interest tax loophole that benefits wealthy money managers on Wall Street.

Managers of various types of investment funds that are structured as partnerships often receive a profits interest in the fund commonly referred to as a carried interest in exchange for their services. WASHINGTONTreasury Secretary Steven Mnuchin said the government will act within two weeks to block a hedge. But under current law fund managers are able to claim this income as capital gains taxed at the preferential rate of 23.

The total federal tax take is a whopping 34 trillion. Then in response to lobbying by affected parties private equity venture capital and real estate. During the last presidential election both Donald Trump and Hillary Clinton vowed to end carried interest.

The only problem is no such loophole exists. Carried interest allows hedge funds to evade their tax obligations. Would if enacted tax all or some of carried interest as ordinary income or treat the granting of carried interest as a subsidized loan.

The loophole exacerbates income and wealth inequality. Kevin LamarqueReuters Tue 14 Dec 2021 0610 EST Last modified on Tue 14 Dec. July 15 2016.

Treasury to close carried interest loophole in new tax lawCarried interest refers to a longstanding Wall Street tax break that let many private equity and hedge fund financiers pay the lower capital gains tax rate on much of their income instead of the higher income tax rate paid by wage-earners.

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Biden Tax Plan And 2020 Year End Planning Opportunities

You Want To Know A Really Dirty Secret Here S Why Democrats Are Protecting Private Equity S Carried Interest Loophole

How To Tax Capital Without Hurting Investment The Economist

You Want To Know A Really Dirty Secret Here S Why Democrats Are Protecting Private Equity S Carried Interest Loophole

States Are Taking Aim At Pe S Carried Interest Loophole Pitchbook

What Is The Carried Interest Tax Loophole

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University

Carried Interest In Private Equity Calculations Top Examples Accounting

What Is The Carried Interest Tax Loophole

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Selling Your Home Low Incomes Tax Reform Group

Carried Interest Definition History And Examples Marketing91

What Uk Tax Do I Pay On My Overseas Pension Low Incomes Tax Reform Group

Carried Interest Loophole Take On Wall Street

Beyond The Carried Interest Tax Loophole Occasional Links Commentary

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube